Advice and Tips

Contribution rates for Tekna members in 2021

As many as 88 % of Tekna members have a defined contribution pension plan. What are the current minimum/maximum contribution rates, and how much does the average member contribute?

A defined contribution plan is the most common type of pension plan in the private sector, which includes many Tekna members. Tekna sends out its biannual survey on working conditions to all its company union representatives employed in the private sector. This survey shows that in the fall of 2021, around 88% of both companies and members had defined contribution plans.

Minimum and maximum rates

The minimum contribution rate required by law is 2 % of salaries up to 12 G (the basic amount G is adjusted annually). There are also limitations on the amount of these contributions: the maximum contribution rate is 7% of salaries up to 7.1 G and 25.1 % of salaries between 7.1-12 G, which is why it’s possible to have significantly higher contribution rates (up to 18.1 G) for salaries over 7.1 G. This is because new contribution regulations in the National Insurance Plan don’t count any portion of salary exceeding 7.1 G. Employers can compensate employees for this shortfall through their occupational pension plans so that the total contribution from the National Insurance Plan and defined contribution plan is the same for different salary levels.

Contributions for salaries up to 7.1 G

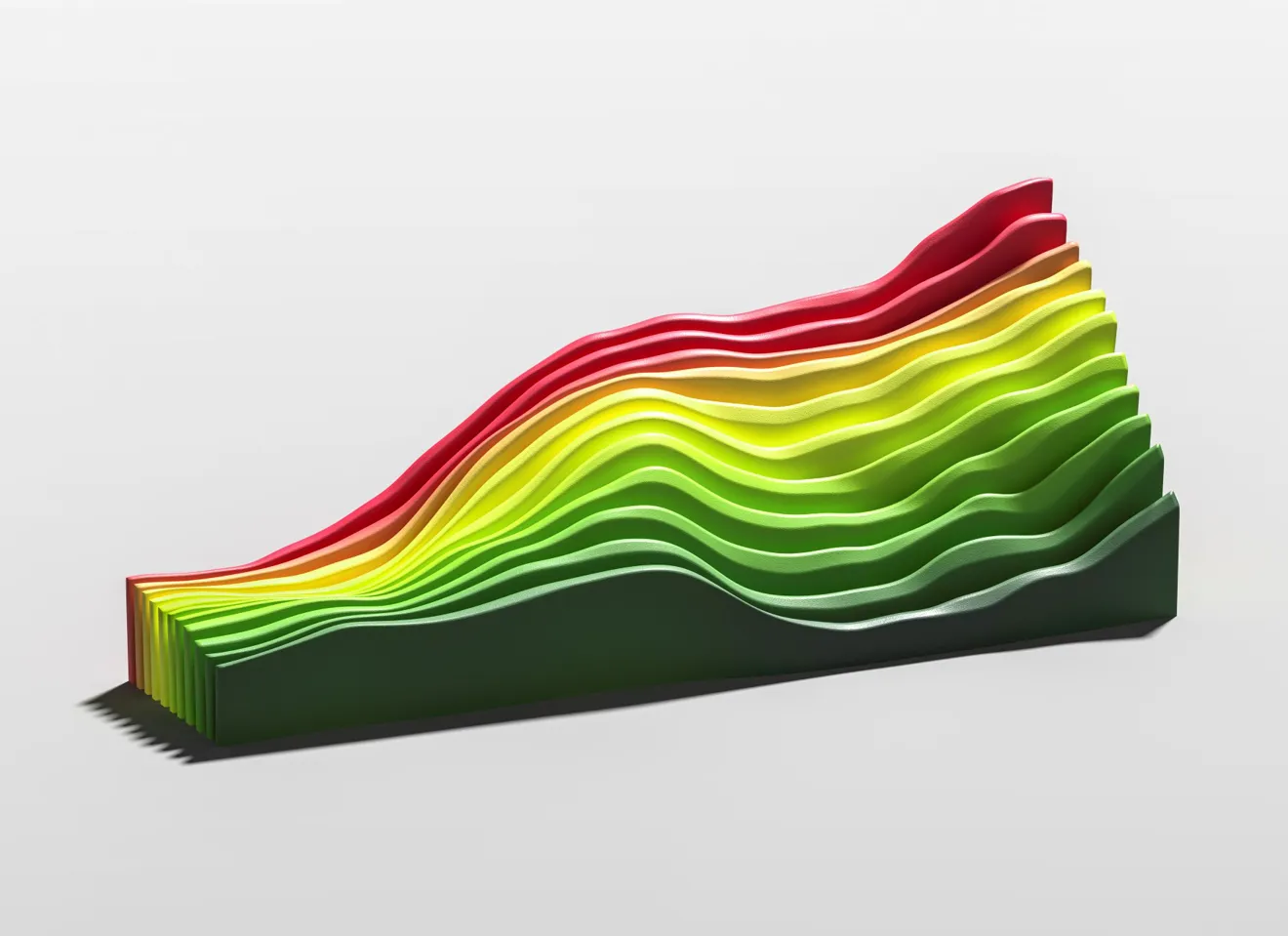

There are very few members who have a contribution rate that’s lower than 5% for salaries up to 7.1 G. When combined, this applies to around 3%, see Figure 2. The most common contribution rates are between 5-6%. Around 1 out of 3 members has the maximum allowed contribution rate of 7%. The average contribution rate for salaries up to 7.1 is 5.9%.

Contributions for salaries between 7.1 and 12 G

The contribution rate over 7.1 G is especially important for Tekna members because of their high level of salary development. Tekna’s salary statistics show that the average member’s salary exceeds 7.1 G after 6 years in the workforce. Around 1 out of 3 members has a maximum (or near maximum) contribution rate (22 to 25.1 %), see Figure 3. The average contribution rate for salaries between 7.1-12 G is 16.3 %.

The rates are correlated

There’s a positive correlation between contribution rates under and over 7.1 G, which are called low and high in the table below. In cases of contributions between 5-6%, there’s a great deal of variation with regard to contributions over 7.1 G. At the top of the table, we see that a 7% contribution under 7.1 G is dominated by at least 22% contributions over 7.1 G.

Saving from the first krone

After June 30th, 2022, it’ll no longer be legal to keep the first G out of a salary when pension contributions are being calculated. In the fall of 2021, around 75% of members had made contributions from their first krone earned. Further, only 1 out of 4 members had made contributions for salaries over 1 G. The statistics in this case apply to both contributions from the first krone and from 1 G.

The survey shows that the companies that have made contributions from the first krone often have higher overall contribution rates as well. Companies making contributions from the first krone have average contribution rates of 6.0% for salaries up to 7.1 G and 17.3% for salaries above 7.1 G. Equivalent contribution rates for these are 5.4 and 13.3%, respectively. So many companies who still don’t offer saving from the first krone should consider increasing their contribution rates when the plan’s adjusted in accordance with the new regulations – that is, if they want to stay competitive with regard to defined contribution pension plans.